Price Over Time!

I started out investing in the market in 1997. If I had understood at that time how important the above statement is I would be a lot wealthier then what I am. I have done many differing trading courses and basically anything I could get my hands on to try to gain some knowledge and hopefully success. Out of all the courses there was only one person who fully understood the above statement and explained how to work it into my trading plan.

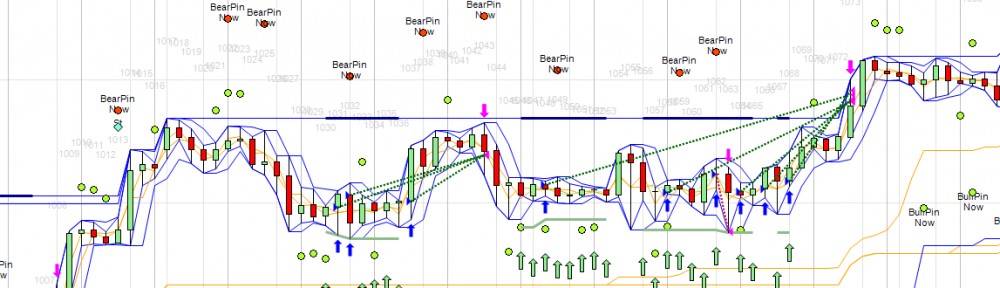

The concept is the most basic of basic concepts and is quite often overlooked. I personally overlooked it for the first 10 years of my trading career. The concept is to measure a stock or whatever you are trading with an up sloping angle which is an average angle of growth. Don’t be to greedy simply go back in time and find an up sloping angle that suits the stocks movements. You can use a weekly chart or longer time frame and there will be an angel that fits. As long as the stock stays above that angle you want to be the owner of that stock. If and when the price declines below that angle the stock has signaled that it can no longer maintain it’s positive strength and that is the time to be out of the stock.

There will be an opposing angle of suppression find that angle it may or may not be equally opposite but it will be there just look for it. When the stock becomes strong and crosses above it’s suppressive down angle that will signal the time and price to re-enter.

The other benefits of an up slope is that you can calculate a percentage of return over time. On the ANZ chart below you can see an up sloping angle that represents 15% per annum. As long as the market maintains this angle your investment will be increasing in value by 15% p.a.

The other type of angle is an ever-increasing angle it may be up or down. It does not make sense to stay with one amount of growth when the rate of growth is increasing. For this reason you will have to increase the angle. Gold was showing this characteristic. I let the price dictate the terms and just follow it. When it broke the supportive angle it did indicate a time to sell out and exit. Which I did at $1690 and will gladly reenter when and if it can break the suppressive down angle or a speculative buy in mid 2014 at $1200.

Below is a good demonstration of this rule. The below chart is Alcoa a big company that produces a valuable product used the world over. A bit of a sideways mover however every time it has broken its suppressive down angle it has been a good opportunity to buy.